The rapid development of artificial intelligence and machine learning solutions further enhance online algorithmic trading. Allied Market Research estimates the global algorithmic market size was at $12,143 billion in 2020 and forecasts it to will reach $31,494 billion by 2028. At the same time, a CAGR is projected to constitute 12.7% from 2021 to 2028. Considering such a state of play, many startups focus their projects on algorithmic trading software.

If you’re interested in knowing what aspects to consider when creating your own algorithmic trading platform, keep reading. Find out the key points of the tech side of algorithmic trading software development and what it takes to make your project profitable.

But first, a quick review.

1

What is algorithmic trading?

Algorithmic trading executes orders (deals) on financial markets according to program code written by a trader and processed by an algo trading application. The code contains parameters (price, timing, and volume) telling the program to open or close a market deal (buy/sell). These process- and rule-based algorithms allow traders to execute thousands or even tens of thousands of orders per second.

Pros and cons of algorithmic trading:

-

Pros

- Removes emotional factor

- Increases activity

- Backtesting based on historical data

- Execution speed far exceeding human trading

-

Cons

- No ability to reject a deal within a trading session

- It might be necessary to write new algorithms very often. The same one can’t be resultative for a long time

- Total dependency on technologies

With algorithmic trading, users depend on the application with which they’re operating. Building reliable software to support sophisticated tech requirements is vital. And it’s necessary to understand what aspects such software should include and how to deliver them. Scroll on to find out.

2

How to make an excellent platform for algorithmic trading?

To develop a robust algo trading platform, you should cover a broad scope of work. Decide where (mobile, desktop, etc.) your platform will be available. Consider design, marketing, development team, features, and much more.

Here’s a brief list of what should be done when developing a comprehensive algorithmic trading software:

- Select the type of your application — mobile, desktop, web, or cross-platform

- Hire professional designers and illustrators to create captivating designs for your application

- Hire an experienced team of developers with expertise in the FinTech domain (check out IT Craft’s positive reviews on Clutch)

- Pay attention to quality assurance and execute testing throughout all stages of product development

- Supply your algorithmic trading platform with must-have features (refer to #4 of FAQ at end of this article)

- Comply with the FinTech regulation:

- Meet all GDPR rules

- Adhere to regulatory compliance of SEC (U.S. Securities and Exchange Commission)

- Become a member of the FINRA (Financial Industry Regulatory Authority), and other regulatory authorities

3

Core steps to start algo trading software development

Like any software, an algorithmic one requires thorough planning: general scope of work, setting global project goals, defining requirements, features, and attributes, etc. You must also take time to seriously consider relevant — and vital for success — marketing aspects.

Consider algorithmic trading strategies

To win over users, your product has to be competitive. To do this, you must meet your target audience’s expectations. To that end, your trading software must provide users with all the necessary data, indicators, charts, and tools, so they can adjust the most popular algorithmic strategies to fit their specific needs:

- Arbitrage

- Trend-following strategies

- Index fund rebalancing

- Mathematical model-based strategies

- Mean reversion or trading range

- Volume-weighted average price (VWAP)

- Time-weighted average price (TWAP)

- Percentage of volume (POV)

- Implementation shortfall

Besides the above-mentioned sources, consider adding FAQs and educational materials to your application.

Build platform architecture

Architecture is the foundation of the entire algo software system. It is key to successful development. Building architecture means defining solutions to meet a project’s functional, non-functional, technical, and operational requirements. When done right, you can enjoy such product quality attributes as maintainability, interoperability, security, and performance.

Ensure software architecture documentation is written clearly and plainly. This will save your colleagues time and energy explaining to newcomers the essence of the project getting new team members up to speed. It’s also an efficient tool to facilitate communication between developers and non-developers of a project.

Let’s discuss the best-fit architecture for your project.

Book a call now.

Contact us

Security

Security of algorithmic trading applications is one of the top priorities for users. It ensures their privacy and protects their intellectual property. Leading software development companies use tried-and-true practices to provide robust security:

- Pentests — “ethical hacking” finds vulnerabilities before hackers do

- Static/dynamic application security testing (SAST/DAST) as part of CI/CD

- Regular security review by a human

- Encryption at rest (DBs, code, backups) and in transit (HTTPS)

- Strict network firewall rules (deny all, allow only required ports to explicit targets)

- State-of-the-art web application firewall

- Workload security monitoring (for this purpose, implement security operations center [SOC])

- Segmentation of networks

- Required MFA

- Anomaly detection based on app metrics

- Pro-active alerting based on logs monitoring

All these security options — and more — are available with IT Craft.

4

Functional developing plan

Tech stack

Depending on your project’s requirements, you must choose an optimal tech stack. In this way, you’ll be able to execute all necessary tech tasks smoothly. With a suitable tech stack, your project infrastructure consumes the least system resources, resulting in faster delivery and lower costs.

IT Craft software development company offers various technologies, infrastructure, methodologies, and more. We help you choose the ones that are best suited for your FinTech project.

Do you want to ensure the best algorithmic software development to be executed and include basic features to capture users’ attention? Here’s a compact yet practical plan.

-

Frontend

- Angular

- React.JS

- Vue.JS

- TypeScript

-

Backend

- Rest API

- PHP 8 (Symfony LTS)

- NodeJS (Express, NestJS)

- TypeScript

- Spring Boot Java

- Serverless:

- AWS Amplify (AWS Lambda, AppSync, Cognito, S3, CloudWatch, Pinpoint)

-

Infrastructure

- Microservice Architecture

- Kubernetes

- Docker, Amazon Web Services (EC2, AWS Fargate, CloudFormation, CloudWatch, S3, RDS, Elasticache)

- Jenkins

- Groovy

- Ansible

- Terraform

- Redis

- RabbitMQ

- Kafka

- Elasticsearch

-

Databases

- MySQL

- PostgreSQL

- DynamoDB

- MongoDB

- Automation Testing:

- Unit

- Integration

- Functional testing

-

Development methodologies

We can also help with iOS and Android platforms software product development:

-

iOS

- Swift

- UIKit

- Alamofire

- SnapKit

- Stripe payments

- Cocoa Pods

- MVP, MVVM

-

Android

- Java 8

- Kotlin

- AndroidX appcompat

- Stripe payments

- MVVM, MVC

- Coroutines, LiveData, DataBinding

Looking for solid tech expertise?

Book a call with our STEM talents and let’s discuss your project.

Contact us

Optimization & performance estimate

There are myriad algorithmic trading applications available in the market. To succeed, you must offer your target audience a top-notch product. One criterium: high application performance. Your software must respond instantly to any and all user actions. No. Delays. Ever. A well-thought-out and optimized code achieves this. Proper optimization requires highly skilled developers with expertise and solid, hands-on experience in coding.

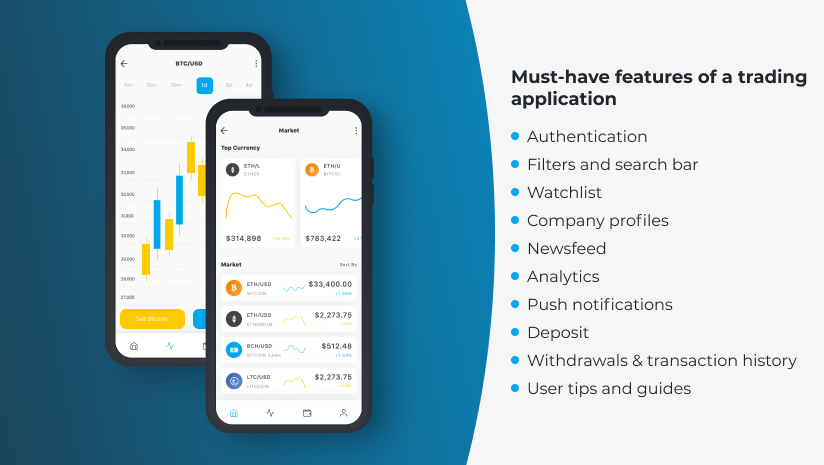

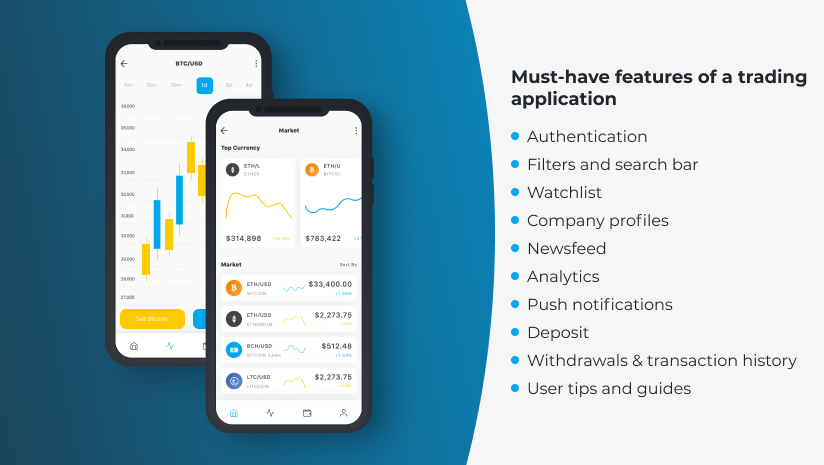

Interface features

Your algo trading software must deliver intuitive navigation and an interactive interface. Attracting and retaining users is essential, so pay careful attention to creating a smart design.

Make sure there’s quick access to all menus and the application provides users with must-have features for the algorithmic trading platform:

- Authentication

- Filters and search bar

- Watchlist

- Company profiles

- Newsfeed

- Analytics

- Push notifications

- Deposit

- Withdrawals & transaction history

- User tips and guides

Pre-prod

Once you designate what your product should look like and what technologies you’re going to use, developers can begin building your software. The pre-prod environment is where it happens. In this environment, a team of developers has access to a repository and executes continuous integration and delivery operations (CI/CD). CI/CD approach allows developers to create code safely and quickly.

Final testing & release

When your algorithmic software is ready, it’s time to test it then release it. Testing happens in the production environment. Even if your team and a tech vendor’s team were extremely accurate during the development phase of a product, testing at every development stage is a mandatory procedure. There are advantages and disadvantages to automated and manual testing. Using both ensures a better end product.

Manual testing is the way to go about complex test cases, UX, and exploratory tests. Automated testing fits perfectly for simpler, more repetitive tests. When choosing your software provider, ensure they can offer you both types of testing. This ensures the best product quality in terms of being almost bug- and error-free. After completing all tests, your algo application is good to go to the market.

5

Is it profitable to develop your own algo trading software?

The market is saturated with algo trading applications, and the competition is high. At the same time, the market size is big enough ($12,143 billion in 2020) to try to capture its share. The size of the share is likely to depend on how innovative your marketing will be, how persuasive your unique value proposition (UVP) and unique selling proposition (USP) will be, and finally, how good your product will be.

As to the latter, it depends on the competencies, expertise, and professional background of the tech vendor your select to develop your algo trading software. Therefore, when choosing a software development company for your project, make sure they possess all these business pillars.

When negotiating a potential partnership, ask a tech provider to showcase their portfolio and case studies of similar projects. Check out a software company’s testimonials and rates on independent sources like Upwork, GoodFirms, and Clutch. Today it’s almost impossible to hide a genuine business reputation. So, if a company exists in the software development market for years, it’s not difficult to get a clear picture of it.

Top Companies for Algorithmic Trading Software Development

Check out the top algorithmic trading software development service providers based on their industry expertise, development capabilities, ability to handle complex requirements, and approach to communication with clients.

1. IT Craft

IT Craft is a leading algorithmic trading software development company delivering full-cycle engineering services for businesses looking to build, scale, or modernize their trading solutions. The company has extensive expertise in the development, expansion, and maintenance of trade and exchange platforms, trade information management solutions.

IT Craft believes in transparent communication, effortless integration between designated experts, and long-term technological partnership – reasons why many clients select the company as their technology provider for trading.

- Services & expertise: Custom trading platform development, algorithmic & automated trading systems, market data processing and analytics, FIX/FAST integrations and connectivity, OTC and white-label trading solutions, crypto/FOREX/multi-asset trading modules.

- Technology stack: C++, Java, Python, Node.js, TypeScript, React, WebSockets, FIX/FAST, Kafka, Redis, AWS, Azure, Google Cloud, Kubernetes, Docker, Laravel, .NET Core.

- Team size: 330 experts.

- Top Clients: LimpidMarkets, Predira, high-load OTC trading systems under NDA.

2. Daffodil

Daffodil Software is a long-term engineering partner for fintech and trading companies that want to ship secure, cloud-ready platforms without losing speed. Their team develops trading applications that support data processing in real-time, automation, and robust backend design to ensure startups and financial institutions can develop ideas and implement them in production without losing control of performance and compliance. Another area where Daffodil has expertise is in legacy financial system modernization so that their customers can grow without cutting off their day-to-day operations.

- Services & expertise: Custom multi-asset trading platform development, algorithmic & automated trading engines, market data ingestion and analytics, trading API & payment gateway integrations, legacy trading system modernization, cloud DevOps for high-load trading environments.

- Technology stack: Java, Python, Node.js, .NET, React, Angular, Flutter, Kafka, Redis, RabbitMQ, WebSockets, AWS, Azure, Google Cloud, Kubernetes, Docker.

- Team size: 1000+ experts.

- Top Clients: F6 Online, Lenskart, Dailymotion, OLX CashMyCar.

3. Artezio

Artezio is a custom software development company with strong expertise in fintech and trading. For more than 20 years, this team has assisted brokers, banks, and fintech start-ups in designing and developing e-trading platforms, financial analytics solutions, and data-driven decision support services. As part of the LANIT group of companies, Artezio blends engineering expertise with industry-specific know-how to transform complex financial processes into secure and scalable trading solutions.

- Services & expertise: Custom trading platform development, automated and rule-based trading workflows, financial data processing and analytics, broker and exchange integrations, risk and portfolio management modules, mobile trading and investor applications.

- Technology stack: Java, .NET, Python, JavaScript/TypeScript, React, Angular, SQL and NoSQL databases, Kafka, Redis, WebSockets, AWS, Azure, on-premise enterprise infrastructures.

- Team size: 500+ experts.

- Top Clients: Raiffeisen Bank (R-Navigator trading and analytics solution).

4. Tickblaze

Tickblaze is a professional-grade algorithmic trading platform built for traders, quants, and investment teams who need a powerful environment for developing, testing, and executing trading strategies. It provides fast backtesting, support for various assets, processing capabilities for real-time data, as well as support for its own scripting engine. Compared to other outsourcing providers, Tickblaze enables companies to immediately utilize its entire environment for quant trading, making it easier for companies to execute strategies.

- Services & expertise: Algorithmic trading platform, automated strategy execution, multi-asset backtesting, live trading connectivity, market data management, portfolio and risk analytics.

- Technology stack: C#/.NET core platform, Python scripting, broker and exchange connectors, real-time market data engines, local or VPS deployment options.

- Team size: 50+ experts.

- Top Clients: Professional traders, quantitative analysts.

5. Empirica

Empirica is a Poland-based algorithmic trading software provider known for building advanced automation and market-making solutions for crypto exchanges, investment firms, and quantitative trading teams. The firm primarily concentrates on assisting clients in fast-tracking strategy development, enhancing execution quality, as well as effectively managing scale-driven liquidity. The products created by Empirica exhibit well-organized engineering coupled with efficiency in market micro-structural concepts to perform algorithms effectively within secure live trading environments.

- Services & expertise: Algorithmic trading platform development, automated execution and market-making engines, crypto trading and liquidity management tools, robo-advisory systems, trading API integrations, real-time data and analytics modules.

- Technology stack: Java, Python, .NET, JavaScript/TypeScript, WebSocket/REST APIs, PostgreSQL, Redis, cloud-ready deployment, exchange and broker connectors.

- Team size: 50–80 experts.

- Top Clients: European cryptocurrency exchanges, market-making firms.

6. Hashcodex

Hashcodex is a fintech software development company specializing in trading and algorithmic trading software development, helping brokerages, trading firms, and crypto platforms launch and scale automated, multi-asset trading solutions. Their focus is on building secure, performant systems with real-time data, execution engines, and full trade-workflow automation – allowing clients to bring trading ideas to life faster and with reliability.

- Services & expertise: Custom trading software & platforms, algo-trading system development, crypto and FOREX trading solutions, market data integration, automated order execution, trading infrastructure modernization.

- Technology stack: Java, Python, JavaScript/TypeScript, Node.js, WebSocket/REST APIs, SQL/NoSQL databases, cloud or VPS deployment, broker/exchange connectors, trading engine frameworks.

- Team size: 10-50 experts (based in India).

7. Algodelta

Algodelta is a niche provider of quantitative and algorithmic trading software, offering a suite of desktop tools built specifically for traders, quants, and portfolio strategists. Their solutions are centered on simplifying complex quantification methodologies to enable research on ideas, evaluation of strategies, and portfolio optimization with minimal coding. Algodelta’s model is anchored on streamlined data-driven processes to enable trading organizations to expedite their transition from basic to applicable strategies.

- Services & expertise: Quant research and modeling tools, algorithmic trading modules, backtesting and simulation engines, portfolio optimization, automated strategy workflows, risk and performance analytics.

- Technology stack: C# and .NET for desktop applications, Python support for quant research, financial modeling libraries, real-time and historical data integrations, local computation engines.

- Team size: 10–25 experts (small, specialized product team).

- Top Clients: Quant traders, prop trading desks, hedge funds, investment analysts.

8. AlgoCodingExperts

AlgoCodingExperts is a boutique development studio specializing in custom algorithmic trading solutions for traders, funds, and small brokerage teams. Their developers focus on turning trading ideas into fully automated systems across multiple platforms, from MetaTrader and NinjaTrader to Python-based strategies and exchange APIs. AlgoCodingExperts is known for its hands-on, collaborative approach – helping clients refine trading logic, improve execution, and automate repetitive workflows with clean, reliable code.

- Services & expertise: Custom trading bots and algorithmic strategies, automation scripts, indicator development, backtesting logic implementation, broker and exchange API integrations, strategy optimization and performance tuning.

- Technology stack: MQL4/MQL5 for MetaTrader, NinjaScript for NinjaTrader, C#/.NET for cTrader and MultiCharts, Python (Pandas, NumPy, TA-Lib), REST and WebSocket APIs, Interactive Brokers API, Binance/Alpaca integrations.

- Team size: 20 experts.

- Top Clients: Forex traders, crypto traders, proprietary trading desks, small hedge funds.

!

The bottom line

Development of algorithmic trading platforms is a sophisticated process. It involves diverse aspects, so it’s crucial to pay attention to more than the tech side of a project. If you want your product to succeed, developing a smart marketing strategy plays a vital role. You have to serve a product that combines both excellent performance and an eye-catching interface, ensuring swift navigation through the whole application. To understand how these elements come together, explore our detailed guide on automated trading system software.