Custom Trading

Software Development

Empower your business with custom trading software tailored by IT Craft – a trusted financial technology partner with 20+ years of experience in web and mobile trading platform development.

Trading Platform

Development Services We Offer

IT Craft provides trading platform development services for hedge funds, brokerages, exchanges, futures commission merchants, and fintechs.

We Deliver Across the

Development Full Trade Lifecycle

- Trading systems / Order Management Systems (OMS)

- Algorithmic trading platforms

- Market data feeds

- Analytics tools

- Client relationship systems

- Trade capture and validation systems

- Settlement and reconciliation tools

- Cash management

- Reporting and ledger systems

- Exception management dashboards

- Market risk systems

- Credit risk systems

- Product control tools

- Scenario analysis engines

- Surveillance systems

- Regulatory reporting tools

- Audit trail and recordkeeping systems

- Trade and communications monitoring systems

Our Case Studies for

Trading Platform Development

Trading Software Development for Predira

Predira Ltd required a flexible PaaS solution allowing traders to configure and deploy custom trading environments in minutes. The platform was designed to serve as a white-label foundation for brokers and fintech startups, reducing time-to-market for new trading products.

IT Craft built a cloud-based, multi-tenant trading platform powered by AWS infrastructure. The team implemented modular architecture with reusable components, enabling traders to customize interfaces, workflows, and integrations under their own branding.

Read MoreOur Expertise In

Trading Software Development

Backed by a skilled team of trading software developers, IT Craft helps businesses build secure, high-performance systems that let end-users exchange any valuable items, both physical and digital.

- Custom Trading Software

- Investment Management Platforms

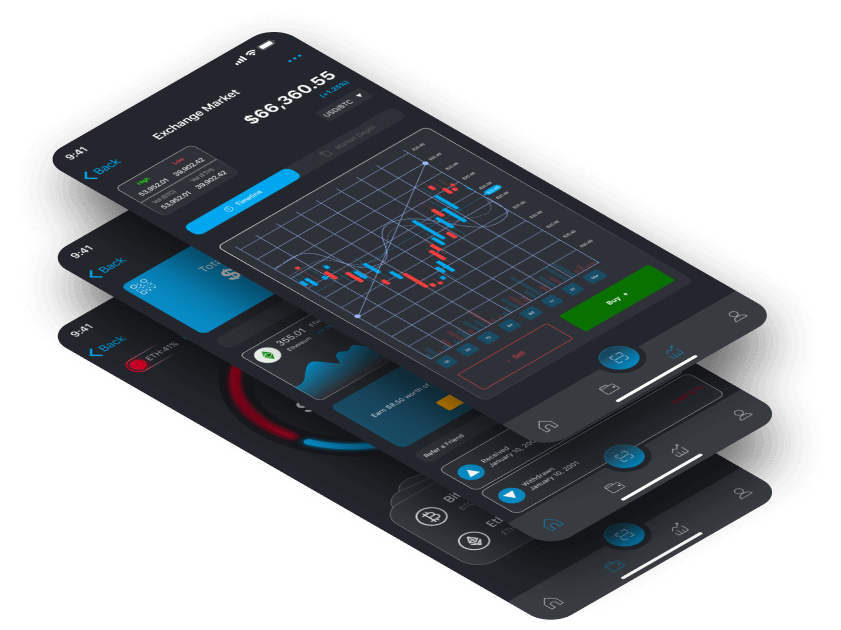

- Mobile Trading Applications

- Trading Execution Solutions

- Forex Solutions

- Market Trends Tracking Apps

- Hedging Systems

- Data Management and Analytics

- Stocks and Equities Trading

- OTC Trading Solutions

- Liquidity Management Systems

- Brokerage Apps

How We Approach

Trading Software Development

Idea & Strategy

We start by discussing your goals, challenges, and business processes to identify the best foundation for your future trading platform.

Product Design & Architecture

Our team defines the system architecture and creates UX/UI prototypes that ensure intuitive navigation and smooth trading workflows.

Development & Implementation

Developers build core platform functionality, integrate APIs, and connect trading, risk, and analytics modules into a secure, scalable system.

Testing & Quality Assurance

QA engineers perform functional, performance, and security testing to verify stability, compliance, and reliability under real market loads.

Deployment & Launch

We deploy the platform to a secure cloud or on-premise environment and ensure optimal performance before go-live.

Maintenance & Continuous Improvement

The system is continuously monitored, updated, and optimized to meet new business, performance, and regulatory demands.

Why Choose IT Craft to

Develop Your Trading Software

Our team brings deep fintech and trading expertise, developing risk management tools, algorithmic trading systems, and analytics dashboards for brokers, banks, and asset managers.

We build trading software with built-in compliance, regulatory reporting, and risk control for advanced monitoring and observability across legacy and cloud systems.

With over 20 years in financial and capital markets, IT Craft delivers reliable multi-asset trading platforms and real-time analytics solutions, helping clients improve performance, scalability, and time-to-market.

IT Craft’s experts deliver front-to-back trading software development – from UX and data visualization to robust server logic and API integrations optimized for speed and scalability.

We ensure smooth handover with full documentation, IP protection, and structured knowledge transfer for long-term ownership of your trading technology.

Contact UsIT Craft in Numbers

-

20+years in trading software development

-

50+delivered FinTech and capital markets projects

-

95%client retention for long-term trading solutions

Our Custom Trading Software Development Services

Frequently

Asked Questions

IT Craft’s trading platform developers empower organizations with global reach, proven delivery models, and deep FinTech knowledge across 50+ markets. We provide flexible delivery models to help companies develop custom trading platforms, modernize legacy systems, and implement cloud-ready, Platform-as-a-Service solutions that scale with business growth.

We design trading software for equities, FX / currency markets, fixed income / rates, commodities / energy, and credit products / derivatives, ensuring high performance across multi-asset operations.

Yes, we have projects of trading platform development in our portfolio. One of them is where IT Craft’s trading software developers built for Predira a trading platform powered by AWS infrastructure, enabling traders to configure and deploy custom trading environments in minutes. The solution serves as a white-label foundation for brokers and fintech startups, combining modular architecture and reusable components to accelerate time-to-market and simplify platform customization.

Which technologies and tools does IT Craft use to build trading platforms?

We use .NET, Java, Node.js, React, Python, AWS, and Azure, along with FIX and proprietary protocols, WebSocket APIs, and microservices architecture to ensure ultra-low latency, scalability, and reliability.

Does IT Craft develop custom software for forex trading?

Yes, IT Craft specializes in custom forex trading platforms tailored for brokers, financial institutions, and fintech startups, featuring real-time execution, risk monitoring, and automated trading capabilities.

What experience does IT Craft have with high-load trading systems and complex data workflows?

We have deep expertise in high-load trading architectures handling millions of daily transactions, real-time data streaming, backend orchestration, and trading execution middleware using FIX and proprietary protocols.

What types of clients and industries does IT Craft serve?

We serve fintech startups, brokerage firms, banks, hedge funds, and investment companies, supporting them with custom trading platforms, modernization, and PaaS-style delivery for long-term scalability.

How much does it cost to develop a trading platform?

The cost varies based on functionality, integrations, and regulatory complexity. Typically, MVP trading platforms start around $80K–$120K, while enterprise-grade multi-asset systems may exceed $300K.

What features can be included in a custom trading platform?

Your trading platform may include real-time market data, order and risk management, automated trading, regulatory compliance, reporting tools, cloud connectivity, and multi-device support for global operations.

Does IT Craft build automated and algorithmic trading software?

Yes, IT Craft develops custom automated and algorithmic trading solutions tailored to clients’ strategies and preferred markets. Our team designs secure, high-performance systems that analyze market data, recognize trading patterns, and execute trades automatically with minimal supervision.