How to build a trading platform? The question is on the agenda of startups in the fintech industry that are gaining traction in investment engagement. The trading app market’s worth is estimated to reach USD 13.6 billion in 2022, with a projected value of USD 89.8 billion by 2032. Such a state of play and promising future of the trading activity opens the door for increasingly more startups to enter the market.

In this article, you’ll learn how to make a trading platform, what aspects to consider, and the challenges within the process. Yet prepare for successful FinTech case studies.

Scroll down to find out how to build your trading platform. But let’s first review what types of trading platforms are currently in the market and the key assets contained in the portfolios.

1

Types of trading platforms

As its name suggests, trading platforms provide market players with options to buy and sell diverse financial assets. Platform portfolios might include securities, bonds, commodities, currencies, precious metals, and other financial assets.

According to the asset classes and user profiles, the common types of trading platforms include:

- Stock platforms. Companies list their shares so market players can purchase them or resell to other traders. Stock markets operate diverse financial instruments, including derivatives like the “call option.”

- Forex platforms. These platforms allow users to buy/sell currencies and earn on exchange rate differences.

- Precious metals platforms. Another type of asset that platform users can buy or sell is precious metals. They are often used as long-term investment financial instruments.

- Commercial trading platforms. Commercial platforms are focused on retail traders and investors. Typically, such platforms provide users access to the most popular financial assets. It’s a supermarket in terms of trading business where retailers can choose from a wide range of products.

- Proprietary (prop) trading platforms. Unlike commercial platforms, prop ones are designed for big financial institutions, like investing banks. The platforms are customized to accommodate professional traders’ needs.

- Cryptocurrency platforms. Market makers can perform traditional swap operations in the crypto market with assets like crypto coins, small caps, mid caps, and large caps cryptocurrencies. Also, crypto trading is on the fire with relatively new assets called basic attention tokens and non-fungible tokens.

- Index platforms. Market indices are used as a barometer of a state economy. For instance, S&P 500 and Dow Jones are standard bearers in the U.S. Yet indices are another common trading asset.

- Exchange-traded funds (ETFs) platforms. ETFs represent a pool (a basket) of securities or precious metals trading on the stock and precious metals exchange.

2

Choosing software platforms for a trading application

Research by BuyShares shows that the top five trading apps aggregate 10+ millions of monthly active users (MAU). Considering thousands of other trading apps have their users onboard, the overall target audience size exceeds the 100 million threshold.

To reach out to as many potential users as possible, you, as a startup, should develop trading applications that will be available through all popular platforms:

Developing alone-standing applications for each platform is costly and time-consuming. The good news is that cross-platform development allows code creation that works for both iOS and Android. That said, choosing between mobile and responsive Web applications is still a matter.

To succeed, you must make data-driven decisions. You should thoroughly work on the discovery research stage (discussed in greater detail in the next section). First, focus on your application’s functionality and picture your target audience’s profile – your avatar.

3

What are the key steps to building a trading platform?

Trading platform app development encompasses several vital stages. The following list describes the essence and common approaches within each stage.

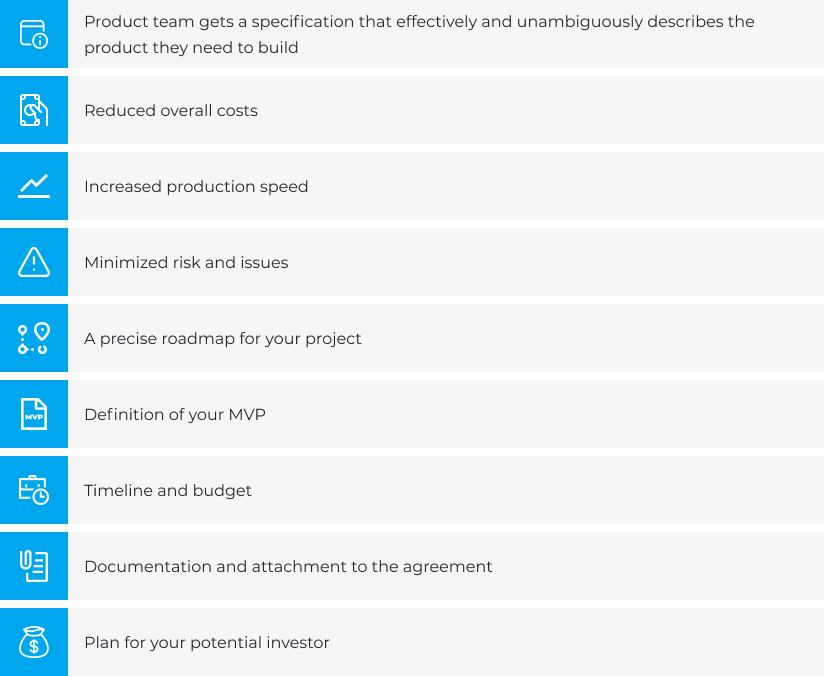

Set up your project

Working on the preparation stage of the project helps you increase production speed, minimize business risks, and reduce overall costs.

Discovery research. Before starting app development, it’s crucial to conduct discovery research. Define your target audience (e.g., by demographic, geographic, psychographic, and behavioral segmentation) and explore their current pain points and expectations from a product in the niche. The more granular the segmentation, the greater your chances of winning users.

To accomplish this, thriving startups do the following:

- Competitors analysis. Make a list of the market’s top competitors in your category. Shortlist it with the most relevant players (e.g., by type of trading assets). Examine their set of features and value proposition. Don’t rush to compare to industry giants as they have enormous budgets and authority unattainable for startups.

- Interview users. Survey different channels employing both online and offline surveys to get valuable and actionable information from potential users. It’s also possible to delegate this task to a survey company. Consider running a focus group interview.

- Interview stakeholders. Stakeholders usually possess deep expertise, insights, and data in their business domain, allowing them to understand the market better. As a startup owner, collect their vision and ideas on what solutions can make a difference to user experience in your niche.

Value proposition. When offering a new trading platform to the market, startups need to provide their audience with reasons why they should use the new trading platform. It has to be a clear and persuasive brand message revealing practical value to prospects. Tell users how they can benefit from your product and how it serves as a unique experience for them.

Idea validation. New businesses are all about bringing better or innovative solutions to users. Before investing significant resources in a minimal viable product (MVP) or a new feature development, determine if it will deliver the desired outcome to your business. At this point, generate testable hypotheses and business assertations.

If you need help creating a robust roadmap for your project, drop a line here. Our project managers are happy to share their expertise.

Define features to include

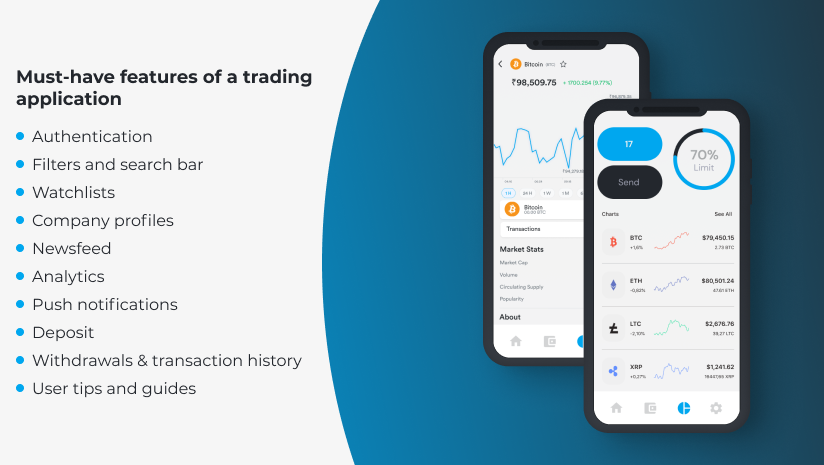

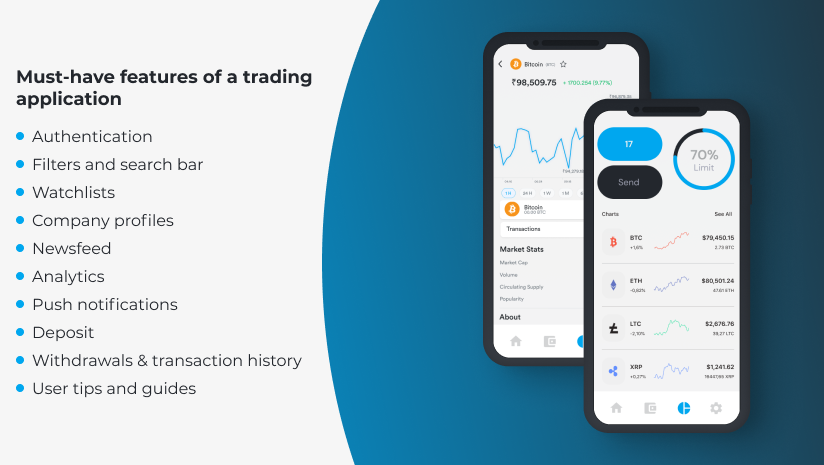

Most trading platforms have similar functionalities. However, a distinct set of features allows each app to attain its marketing advantage.

We prepared a check list of elements to consider when creating your trading platform application:

Signup and login (Authentication). When it comes to signing up for financial applications, users want to be sure their data is secure. Therefore, it’s reasonable to support a one-time PIN (OTP) authentication, multi-factor authentication (MFA), and biometrics authentication methods. For the latter, you can benefit from face ID technologies (Apple’s Face ID, for instance).

Entering a personal account should allow users to edit and update settings and profile data, track transactions, and monitor all quotes in real time. When your project grows, think of designing several interface themes, so users can customize their profiles.

Filters and search bar. Trading is oversaturated with data. Help your users intuitively navigate your application and quickly find urgent data. Create a list of filters allowing traders to see market data by assets and their long-term/short-term durability, volatility (say hello bitcoin volatility), companies, and other criteria. Design sub-filters to each category, where possible, to improve user experience (e.g., you can add “strike prices” per “call option” and “put options”). Also, add a search bar, so traders can find necessary information using keywords.

Watchlist. A watchlist helps users see current trading opportunities, estimates trend direction, spots hot stocks or other assets, tracks portfolio performance, and collects a ton of other insightful data. It’s a convenient way to exercise primary market research. You can offer your curated watchlist but let the users customize it independently. Add a watchlist editor feature to your application.

Company profiles. Let users analyze portfolios of market leaders and adopt their trading approaches accordingly.

Newsfeed. Trading is based on collecting and analyzing data and the ability to act on it promptly. Offer a newsfeed in real time where users can find insightful news and updates (e.g., exchange rates, initial public offerings).

Analytics. Your trading platform must provide users with trading charts, indicators, and historical benchmarks. Think of pinning a data chart at the top of the newsfeed.

Push notifications. To ensure users receive critical data, breaking news, and updates instantly, add push notifications to your app. Real-time alerts are essential to track movements in the market. Set reminders and stay updated on the news that affects time-sensitive assets with high volatility.

Deposit. The deposit feature allows traders to replenish their accounts with wire transfers and see the status of their deposits.

Withdrawals & transaction history. Users need access to the entire history of their deals and transactions. It allows them to track the movement of funds within their accounts.

User tips and guides. To facilitate their onboarding to your trading platform, provide users with educational materials, lifehacks, pro tips, FAQs, and other information. Ideally, arrange your training and tutorial programs and a 24/7 customer support team, but that tends to be pricey. Start off with tips and guides.

Plan the project’s budget

Launching your trading platform requires well-thought-out budget planning. Any mistakes made here could cost you the complete project success. Did you know that running short of cash is one of the top reasons startups fail?

Defining mandatory and optional expenditures for your projects and planning your revenue streams are crucial. Don’t be obsessed only with a financial strategy for your product development. Think of tactics to attract your first pool of prospects, too. You can create the best trading platform ever, but no one will use it if nobody ever hears of it. So, it’s a constant juggling of product quality and marketing activity.

From the very beginning of the project, try to adjust your budget spending to cover the following categories:

- Team. In the early stage, you must structure your core team. Hire only talents proficient in the trading platforms niche, so they can hit the ground running. As a startup, your product delivery must be fast. Refrain from team expansion unless it’s vital. The fewer people in your team, the quicker the communication and the better performance and velocity achieved.

- Sales and marketing. Be prudent here. Run some budget-friendly marketing activities to help you better understand your target audience. Purchase insightful reports from authoritative sources in your business domain. Or invest in a consultation with an expert to get relevant insights. Do not overspend on promo activity at this stage.

- Product development. The shorter the time-to-market you have, the more time you have to adjust your product to meet the needs of your target audience. As they say, “You can’t edit a blank page,” so release your MVP as quickly as possible. Collect feedback and behavioral data, use heatmaps, and analyze user journey maps (both mobile and desktop if that’s the case). Use the data to edit your product accordingly.

Consider security aspects

Bad actors go where the money flows. Hence, you absolutely must include extensive data security measures when developing a competitive trading platform. This is a matter of gaining a credit of users’ trust that eventually translates into a market advantage.

To tackle security challenges, leading software development companies adhere to these time-tested approaches to:

- Pentests on a regular basis

- Scripted compliance (in continuous integration/continuous delivery [CI/CD]) accompanied by a regular review

- Static/dynamic application security testing (SAST/DAST) as part of CI/CD

- Regular security review by a human

- Encryption at rest (DBs, code, backups) and in transit (HTTPS)

- Strict network firewall rules (deny all, allow only required ports to explicit targets)

- State-of-the-art web application firewall

- Workload security monitoring (for this purpose, implement security operations center [SOC])

- Segmentation of networks

- Required MFA

- Single sign-on (SSO) implementation, if possible

- Anomaly detection based on app metrics

- Pro-active alerting based on logs monitoring

This comprehensive list of security solutions is available when you partner with IT Craft.

LOOKING FOR SOLID TECH EXPERTISE?

Book a call with our STEM talents and let’s discuss your project.

Book A Call

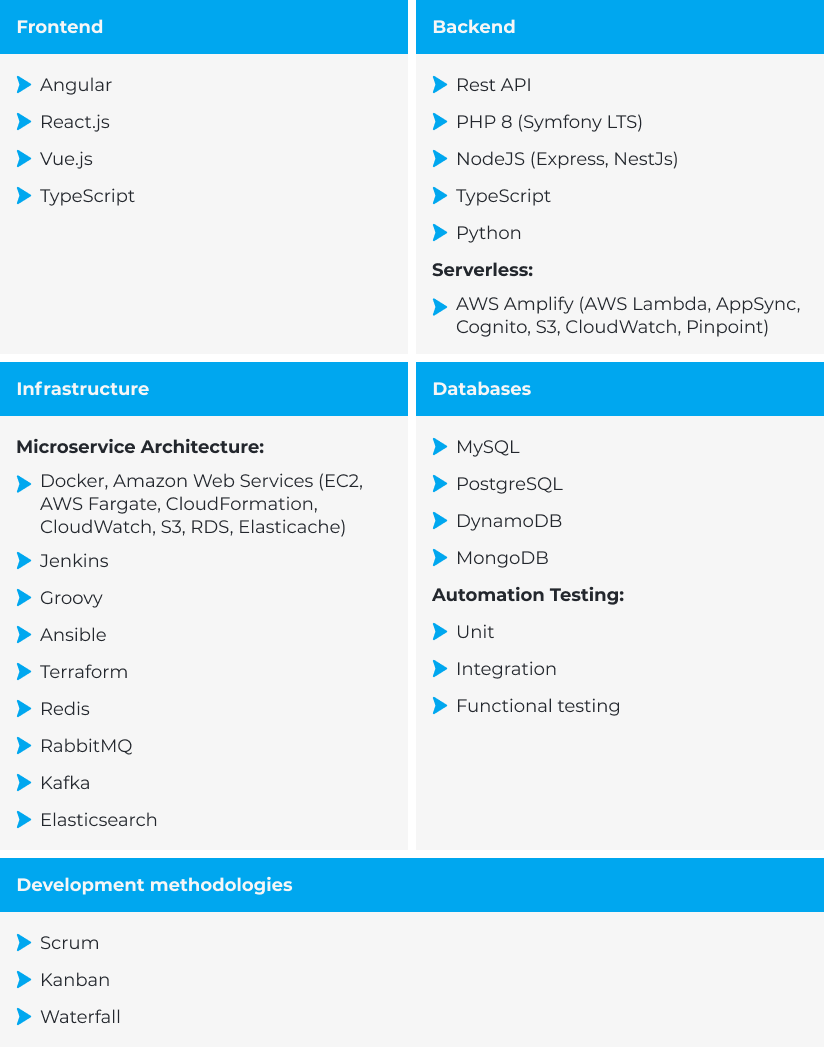

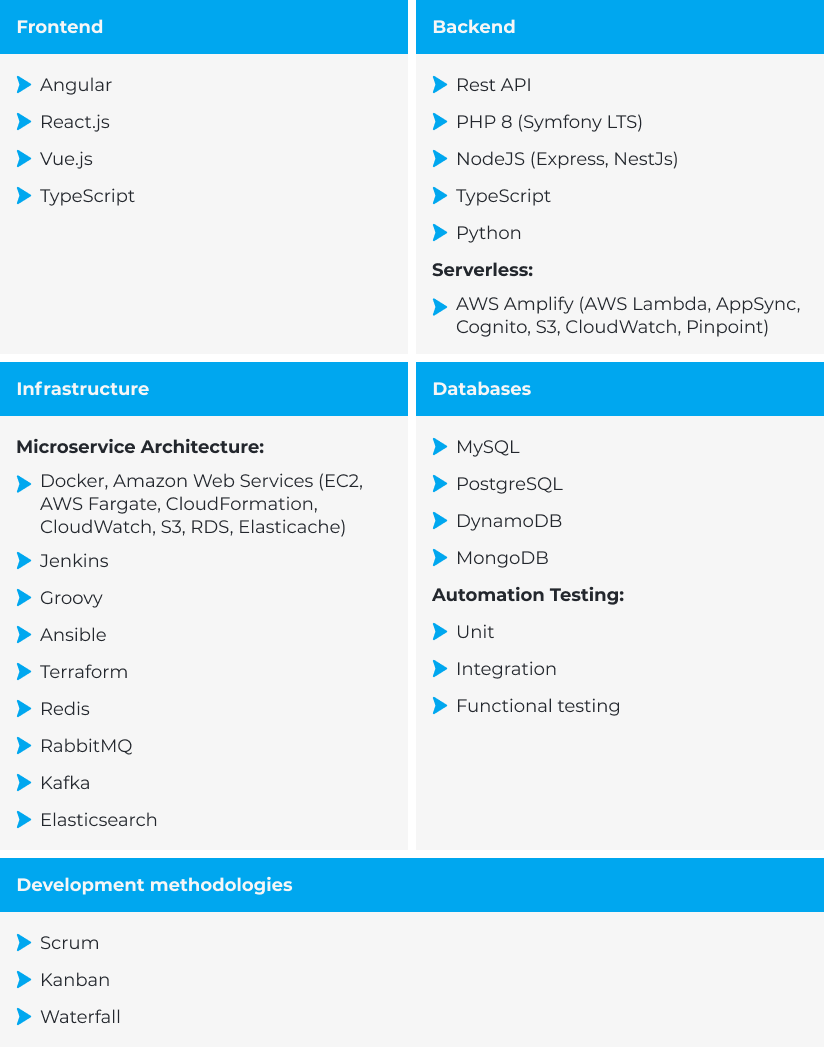

Select a tech stack

When choosing a tech stack for your project, requirements speak. For example, if you’re going to work with banking APIs, protocols, and standards — Java would fit nicely. For solutions involving automated trading strategies, it’s crucial to select languages and frameworks that ensure speed, stability, and seamless data processing. Remember that startups typically succeed when adjusting light programming languages like PHP (Symfony LTS) or Node JS (NestJS/Express).

When considering development methodology, it’s reasonable to think of microservices architecture. It can support multiple technologies, helping developers to solve different tech tasks efficiently.

Partnering with IT Craft software development company allows startups to harness the advantages of microservices architecture and much more:

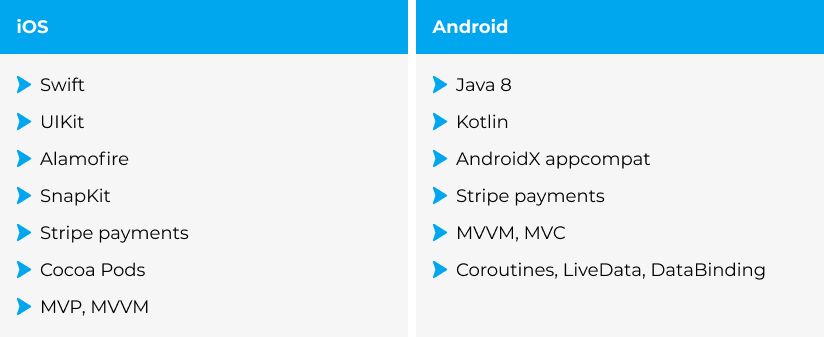

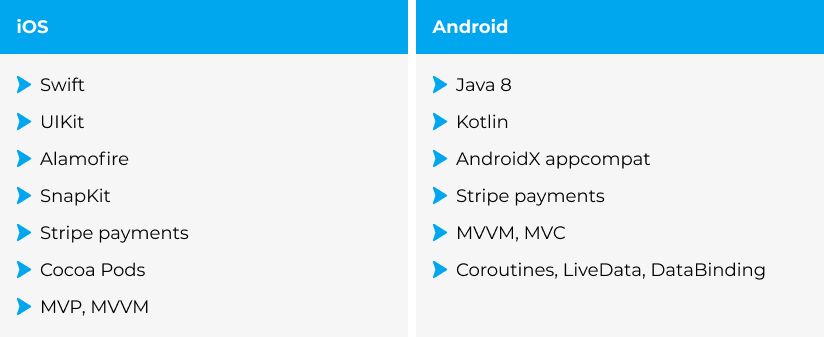

Regarding iOS and Android platforms, you can work with the following options:

Now it’s time to plan how your product will be profitable.

Choose your monetization strategy

Trading platforms can be monetized in several ways. Your choice depends on the specific details of both your application and your target audience.

Subscription fee. It’s as simple as it sounds. Trade platforms derive their earnings from daily/weekly/monthly/annual or lifetime subscription fees. Users get full access to all features of an application with no ads.

In-app advertising (IAA). One of the most popular application monetization models is the one in which app owners gain revenue from advertisers — banners or even interstitial videos between menus (playing video ads amid trading sessions is a bad idea). There are many different ad formats and types to choose from. Thus, app publishers can create different ad placement strategies. Conversely, users consume all platform features for free.

In-app purchase (IAP). Trading platforms can shape a large pool of MAU, luring them with subscription- and ad-free applications. Such applications offer users free access to all features necessary to execute trading operations. However, users can purchase extra features to improve their experience. It’s not mandatory for daily trading, but it can, at times, make a difference for a trader.

To promote their set of features, app owners can provide their users with a free trial period of the features, called the freemium model.

Fees and interests’ model (a.k.a. Payment for order flow [PFOF]). This model allows app owners to make money by charging a per-transaction fee. It can either be a fixed rate per transaction or a percentage of a sum. However, there can be different tariffs for different sums.

Mixed model (a.k.a. hybrid monetization model). Another high-ranking monetization approach. It allows trading platforms to diversify their revenue streams. Traders can combine any of the above-mentioned models and switch to another anytime they need.

Hire your development team

In most cases, to develop a trading platform application, you need a team with the following expertise:

- Project manager (PM)

- Business analyst (BA)

- UX/UI designers

- Back end developer

- Back end developer

- QA specialist

- DevOps

- Application developers

Today, startups can choose between developing their application with an in-house team or partnering with outsourcing companies. Besides saving time and significant project costs, hiring an outsourcing software development team allows startups to completely delegate technical management to a team of professionals. Thus, startups can focus on their core business goals.

As the business owner, ensure your potential software provider can provide the following services and principles:

- Their team members have both advanced hard and soft skills.

- Fluency in English — both written and oral. Must reply quickly to your messages, emails, meeting invitations, etc.

- Adjust working hours to your needs and organize night shifts, if necessary.

- Consider partnering with a multicultural organization

- Solid expertise and experience in your business domain

- Successful, verifiable case studies and testimonials

Outsourcing has been a popular option for trading platform developers for many years. CEE region countries are top players in the outsourcing market: Ukraine is one of the leaders in this geographical area. IT Craft is a Ukrainian IT company that provides software and business development talents with expertise in the trading niche. Also, the company’s employees are proficient in technical and business English.

4

How to Create a Forex Trading Platform

Building a modern Forex platform requires a structured approach, careful compliance planning, and the right technical partner. If you want to move faster and avoid costly mistakes, consider partnering with a team that specializes in trading platform development services.

1. Plan Your Business Model and Compliance

Start by defining your core trading model, revenue streams, and user segments. Ensure the platform aligns with regulatory standards like KYC/AML, data protection rules, and regional Forex licensing requirements.

2. Design the Platform Architecture

Create a scalable, modular architecture capable of handling live market data, user actions, and transaction flows in real time. Consider microservices to keep the system flexible and resilient under high loads.

3. Integrate Liquidity and Market Data

Connect your Forex platform to reliable liquidity providers and trusted market data sources. This ensures accurate prices, fast execution, and a seamless trading experience.

4. Develop Core Features and Security

Implement essential features such as order execution, charts, analytics, user portfolios, and payment flows. Strengthen the platform with encryption, MFA, anti-fraud tools, and continuous security monitoring.

5. Test, Launch, and Optimize

Run functional, performance, and security tests to validate stability under real-world conditions. After launch, track user behavior, optimize speed, and iterate based on trader feedback.

5

Common challenges

Finding affordable talents on time. Developing a trading platform app requires a team of top talents on board to succeed. And it’s not easy to find a specialist with the necessary background quickly since the FinTech industry is sophisticated. So, the problem of engaging the right teammate at an affordable price is on the industry’s agenda.

Raising venture capital. Many investment platforms like SeedInvest, AngelList, StartEngine, etc., help startups in fundraising and crowdfunding. Indeed, it’s a way to attract money from multiple retail investors. But finding strategic investors with expertise in the FinTech industry is a challenge. Such investors possess intelligence and insights and are well-versed in the market. Hence, startups must provide their unique selling proposition to capture customer attention.

Changing regulations. Authorities strictly regulate financial markets. To avoid significant penalties and lawsuits, startups must constantly monitor regulations and be ready to adjust them to their applications in a timely manner.

To learn more about legal aspects that regulate trading platforms’ activity, download our eBook «FinTech Regulation: Key Authorities in the US, UK, EU, and AU markets».

Competing with big corporations. Online trading markets are fiercely competitive. Besides thousands of other trading platform startups, the competitive tension is fueled by the so-called big four brokerages. To succeed, startups must take their marketing advantage with an impressive value proposition, outstanding user experience, and enticing fees.

User acquisition & user retention. Winning customers is the key revenue source for business. Winning is the challenge. To address the challenge, startups shouldn’t neglect the potential of guerilla marketing. On top of that, they can experiment with paid ads, social media outreach, and crowd marketing. Find out what works best for your project and focus the marketing budget on that channel.

5

How much does it cost to build a trading platform?

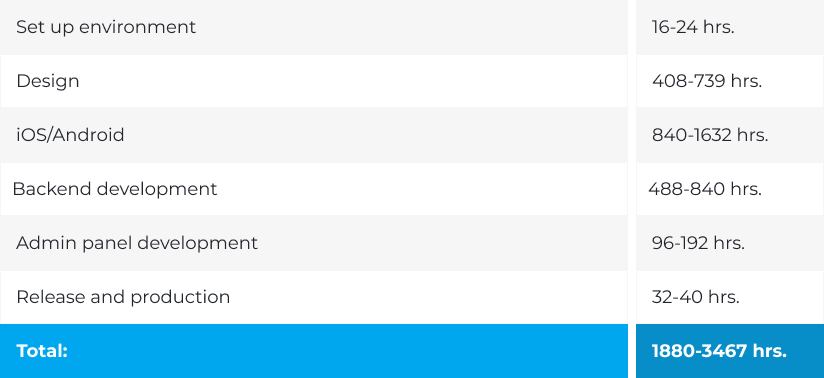

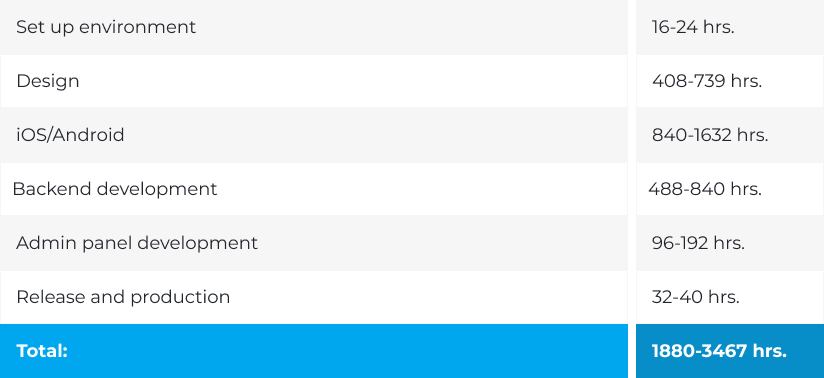

Having established the general scope of work to develop your trading applications, it’s time to get a cost estimate.

Since software engineers in different countries have different hourly rates, the value can significantly vary from $20 to $250. The same pricing aspect refers to all other team members: PM, BA, QA, etc.

Depending on the complexity and functionality, the time needed to develop a trading application varies accordingly. Typically, trading application development takes 5–10 months. Eventually, the overall cost might fluctuate from $47,500 – $125,000.

6

IT Craft expertise

IT Craft has a solid portfolio of successful projects, including those in the FinTech industry. How do FinTech projects benefit from a partnership with IT Craft?

Predira

Predira is a customizable web-based trading software platform that enables businesses to launch their own OTC trading environments in just a few minutes. Designed as a flexible, white-label system, it allows traders to adopt the core logic of LimpidMarkets or tailor it fully to their business needs.

The client wanted to accelerate development by leveraging IT Craft’s fintech expertise and create a platform-as-a-service solution that supports a wide range of trading products — including complex OTC instruments. Another goal was to ensure strong scalability: start with a small team, keep development predictable, and roll out frequent releases based on user feedback.

IT Craft delivered a configurable trading platform builder, a fast and intuitive web app supporting real-time operations, and a secure AWS-powered infrastructure. The solution enables traders to configure products, customize branding, and streamline negotiation workflows while maintaining high performance and transparency.

As a result, Predira launched on time and within scope, giving the client a reliable white-label trading platform that reduces operational costs, supports rapid product replication, and makes it easy for brokers to bring new OTC solutions to market.

!

The bottom line

Developing a new trading platform application requires top-level engineering expertise. While startups have to elaborate on diverse stages even before they start creating their new product, there are also plenty of aspects and risks to consider within the development lifecycle. Failure at one of the aspects may seriously affect the entire project.

Crucial to your project’s success is to involve experienced stakeholders and talents in your project. IT Craft’s seasoned BAs can help your business with research and analytics from the early stage preventing strategic pitfalls. Their expertise will mitigate the risks and ensure high performance.