Easy to learn, hard to master.

Crypto trading seems simple. It is not. Winning crypto trading strategies requires more than just reading charts or copying moves of successful traders.

To be successful, crypto traders need a strategy. To form a strategy, crypto traders must have in-depth knowledge of crypto technologies and crypto trading markets. They must monitor both market parameters and news to successfully handle their positions.

Why? Volatile market forces profoundly impact crypto assets. Herein lies the main difference between crypto trading strategies and stocks, futures, or fiat currency markets.

Read about the distinctive features of crypto trading and related approaches. Decide on the most profitable crypto trading strategy for your particular goals.

1

Simply Put, What Is Crypto Trading?

Crypto trading means the exchange of digital or virtual coins and their derivatives for fiat money or other crypto currencies to profit on price fluctuations.

Unlike trading stocks and fiat currencies, crypto coins are new, intangible assets.

They are based on blockchain technology. The use of blockchain enhances anonymity and security yet eliminates double-spend by keeping a record of all completed transactions.

Possible crypto trade pairs include:

- cryptocoin ↔ stablecoin – cryptocurrencies are exchanged for stable, reference currencies that are fixed to fiat currencies or precious metals (e.g., US dollar or gold).

- cryptocoin ↔ cryptocoin – digital coins are traded against each other (e.g., Bitcoin – Tether).

- NFT (non-fungible token) trading – buy an NFT token for crypto coins for resale in the future.

Although the crypto trade process follows the stock or currency trading pattern, some specifics apply. The following specifics determine crypto trading strategies:

- High-level decentralization – Local authorities have low-to-no influence on trade processes.

- Low entry barriers – It is easy to start and run an account. No need for brokerage or licenses. P2P (peer-to-peer), low-cost transactions prevail.

- High volatility – News and trends affect the market fast and dramatically. Often mere seconds make the difference between massive profit and loss.

- Bans and regulations – Governments can claim crypto operations illegal at any time. Even news about possible bans/regulations heavily affects trades.

- Technology decisions – If stakeholders disagree on the evolution of their coin, they design competing forks. The result is always value fluctuations.

- Learning curve – With constantly growing competition, crypto trading has a learning curve. Skills, knowledge, and experience remain essential for successful trades.

2

Types of Crypto Trading Strategies

Crypto traders choose the best-suited strategy based on available time and resources.

Crypto trading strategies will differ for short-, mid-, and long-term traders. However, retaining focus at all times is crucial.

The biggest difference from traditional stock exchanges: the crypto market is intensive. It never sleeps. It is easy to start a trading session in the early afternoon and segue into late-night trade.

Yet, no one can sit 24/7 in front of a monitor. Hence, discipline is critical when following crypto trading strategies.

Crypto traders need to clearly determine when they start and end. When they abide by long-term crypto trading strategies, they need not update their newsfeed every five seconds.

Consider the following most common strategies used by crypto enthusiasts:

Day Trading

Day trading crypto is a short-term trading strategy. Traders buy and sell assets during the same day or trading session.

Day traders profit on price fluctuations, just like in traditional stock/currency markets.

However, trade intensity and volatility differ. Prices can easily fluctuate 5 – 10% or higher within a single day.

As a result, crypto traders need more finely honed skills, market awareness, and strict adherence to selected strategies to attain long-term investment returns. An attempt to hold a position for a bit longer because the curve keeps steepening might result in a loss. So does an unlucky timing for entering a position.

Effective software solutions positively affect crypto trading. For instance, high-frequency day trading could involve dozens of operations per second. This is beyond human capability but entirely possible for trade bots.

Scalping

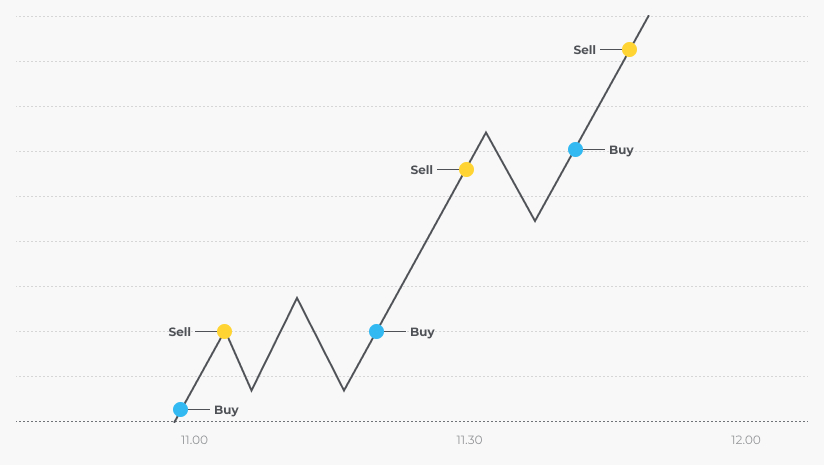

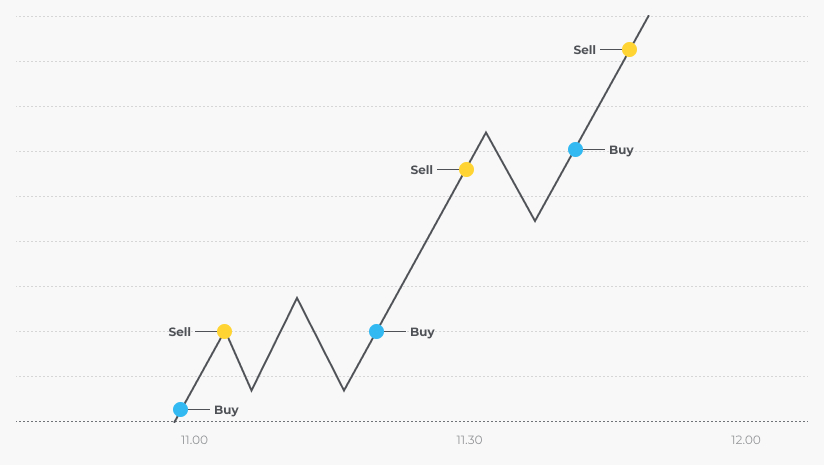

Scalping is one of the shortest-term techniques. Scalping traders open and close the same position multiple times a day.

Traders follow the general trend. However, they hold a position for minutes or seconds—enough to generate a small profit. Then, they close it to fix the profit and reopen it when the uptrend continues.

By doing this, crypto traders hope to capitalize on rising trends yet evade instant losses caused by volatility.

Frequency and timing are crucial. Traders can end a session with a substantial gain when they perform enough successful executions.

Scalping is considered one of the most profitable and low-risk strategies.

It is a high-frequency technique. Scalping traders benefit from trade automation. They can set up a bot that does trading based on technical indicators and market signals. Bots take pressure from traders about the right timing and help focus on priority activities, e.g., portfolio balancing.

Swing Trading

Swing trading is a mid-term strategy when traders aim to profit from a significant price move that happens in the course of several days or even weeks.

Instead of trying to benefit from incremental-yet-small price moves, traders focus on strong market trends that become visible over a long-time segment. Typically, they look for trading swing highs and swing lows. The former signals on position closing. The latter on the starting point for position opening.

Swing traders rely heavily on technical analysis to spot daily and weekly trends. Swing traders, unlike daily traders, focus on fundamental processes. They check medium- to high-time frame charts rather than constantly monitoring indicators.

Swing traders spend less time on trading activities and still get a good profit.

Position Trading

Position trading is a long-term crypto strategy. Traders hold a purchased asset for a long time—weeks or months. Hold time is longer than with swing trading.

Position traders pay little attention to daily swings and dips while focusing on the overall picture. Both technical and fundamental analyses are important for spotting true trends and avoiding noise.

Although position trading works for trending assets, it could show better results than short- and mid-term strategies. (Remember the Bitcoin price in 2011?) Expertise, patience, and sticking to the initial plan are key to successful long-term trades.

Another benefit of position trading: you can start small and expand over time. Still, crypto traders must remember they do business in a risky market. They must remain current with the news to avoid sudden losses.

Arbitrage Trading

Arbitrage is a short-term strategy. Similar to the stock market, traders buy a crypto asset on one platform and sell it as soon as possible on another, making profits on price discrepancies.

Arbitrage is suited for crypto trading. Crypto trading platforms are decentralized. Prices for the same coins fluctuate from platform to platform, thus, creating opportunities.

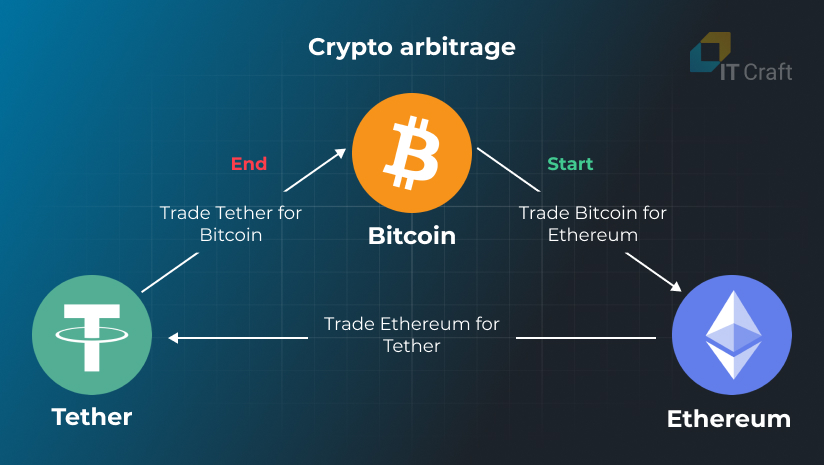

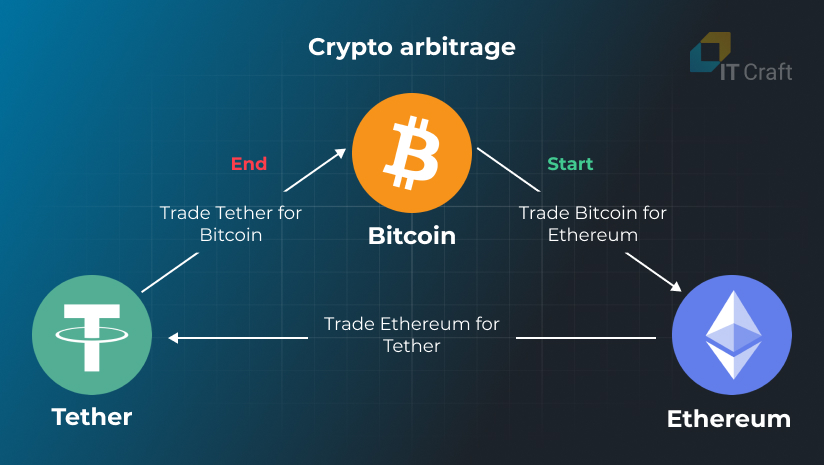

Apart from buying and selling the same coin on different exchange platforms, triangular arbitrage is popular among crypto traders.

With triangular arbitrage, traders trade one cryptocurrency for another, less-known and undervalued cryptocurrency. Then they exchange the undervalued cryptocurrency for a third cryptocurrency that is overvalued. The third cryptocurrency is traded eventually against the first.

Arbitrageurs use automation software widely to monitor price differences and place/execute orders immediately.

Risks associated with arbitrage remain, e.g., liquidity. A trading platform may not be able to execute large order volumes due to the low liquidity of certain cryptocurrencies. Fees, withdrawal, and exchange commissions apply. They eat away at profits.

DO YOU WANT A SPECIFIC SOLUTION FOR INTENSIFIED TRADES?

Let’s discuss your idea now.

Contact Us

3

What Crypto Strategies Are the Most Profitable?

In short, every crypto trading strategy can bring a profit when executed accurately.

The amount of success differs. It all depends on vital parameters such as:

- previous experience in trades

- amount of time allocated for trading activities

- awareness of how crypto technologies work

- savviness in the crypto market

The points below help you shape a winning strategy:

- Start small when you are new to crypto trading. Invest only a set amount of money you are not afraid to lose.

- Select established, liquid assets. You need a crypto coin with a lot of currency associated with it and with many people trading it. You can exchange liquid assets easily in case something goes wrong.

- Focus on a strategy that fits in with your daily schedule. If you do not have a lot of free time, you should avoid day trading.

- Research thoroughly. Learn technical documentation. Make sure you understand platform fees and limitations to avoid losses.

- Avoid hype-based decisions. Stick to your strategy. Check whether you are reading real, credible news—not someone striving to monetize on panic behavior.

- Consider trade automation tools. Set up a trading bot to monetize on trends. Bots spot changes and react immediately based on set-by-you algorithms.

- Build and then balance your portfolio. You might want to trade several assets to diversify risks. Exchange them based on each asset’s performance.

!

Conclusion

A well-thought-out strategy is the most profitable crypto trading strategy. It makes profit generation possible.

Choice of relevant crypto trading strategies depends on goals:

- Traders who have time and want regular income might decide on a short-term strategy.

- Those with little time yet eager to reinvest when a better opportunity emerges might stick to mid-term strategies.

- Users who know the market trends and have enough patience might select a long-term strategy.

Apart from trade techniques, there is a lot to consider. Traders need knowledge of:

- rules and mechanisms of particular trading platforms

- factors that do have impact on crypto assets’ indexes

- risk management tools

Also, taxes, fees, and commissions impact profits and must be factored in.

Trade automation tools simplify traders’ lives. Successful traders do not set up bots and leave them. They regularly amend bots based on market trends.

Last but not least. The best trading tools are custom and proprietary. Why? This makes it possible to secretly build a competitive advantage and use it securely. Custom trading software development makes it possible.